July 15, 2024

Do S-Corps Work? A Data-Backed Guide for the Self-Employed

As a self-employed professional, you're always looking for ways to save money and streamline your business operations. One powerful strategy that often goes overlooked is the S-Corporation (S-Corp) tax structure. In this post, we'll break down what an S-Corp is, how it works, and why it could be a game-changer for your business.

What is an S-Corp?

An S-Corp is a federal tax election that allows certain businesses to be taxed as pass-through entities. This means that instead of the company paying taxes on its profits, the income "passes through" to the owners, who report it on their personal tax returns.

How does an S-Corp work?

When you operate as an S-Corp, you wear two hats: you're both an owner and an employee of your business. This dual role is the key to the tax advantages of an S-Corp. Here's how it works:

1. You pay yourself a reasonable salary as an employee of your business.

2. You pay regular payroll taxes (Social Security and Medicare) on this salary.

3. Any additional profit from your business can be distributed to you as an owner's distribution, which is not subject to self-employment tax.

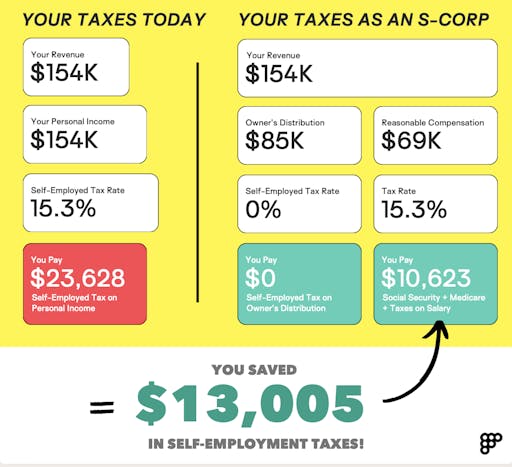

The S-Corp Advantage: A Real-World Example

Let's look at a concrete example from our recent tax savings report. Across thousands of tax returns we analyzed, the average annual revenue for self-employed professionals in our study was $154,433. Here's how the tax situation would differ for a sole proprietor versus an S-Corp:

Sole Proprietorship:

- Total Revenue: $154,433

- Self-Employment Tax (15.3%): $23,628

S-Corp:

- Total Revenue: $154,433

- Reasonable Compensation: $69,000

- Payroll Taxes on Compensation (15.3%): $10,623

- Owner's Distribution: $85,433 (not subject to self-employment tax)

Total Tax Savings: $13,005

That's right - in this scenario, the S-Corp structure saved $13,005 in self-employment taxes alone!

Who benefits most from an S-Corp?

Our data shows that S-Corp savings are significant across all income levels, but they're particularly impactful for those earning between $100,000 and $499,999 annually. For these income brackets, S-Corp savings accounted for over 50% of their total tax savings strategies.

Is an S-Corp right for you?

While the tax savings can be substantial, it's important to note that S-Corps do come with additional responsibilities, such as more complex tax filings and the need to run payroll. However, for many self-employed professionals, the benefits far outweigh the added complexity. And luckily, solutions like Formations are here to help with both automation and expertise.

In fact, our report found that across all income levels, S-Corp tax savings averaged $9,040 per year. That's a significant chunk of change that could be reinvested in your business or personal goals.

Conclusion

The S-Corp structure is a powerful tool in the self-employed professional's tax-saving toolkit. By allowing you to potentially reduce your self-employment tax liability, it can lead to substantial savings year after year. However, like any business decision, it's important to consult with a tax professional to determine if an S-Corp is the right choice for your specific situation.

Did you know that your Formations subscription gives you access to powerful AI-backed software, but also a team of tax and accounting experts at your fingertips?

LET US HELP YOU CHOOSE A PLANRemember, at Formations, we're here to help you navigate these decisions and implement tax-saving strategies that work for your unique business.

Want to see how much you could potentially save? Check out our free tax savings calculator to get started!